When we initially left 2019 behind, the biggest issue facing the market was the aftereffect of Brexit on the industry. In March 2020, the global Covid-19 pandemic diverted this concern. Social distancing rules came into play, non-essential shops closed for several months, and we entered our first national lockdown. But how did the pandemic housing market develop and why did house prices increase during the pandemic?

The pandemic housing market during lockdown

During the first lockdown the property industry came to a grinding halt for a month during April 2020, and concern for the recovery of the market grew. A year later though, the housing industry has seen one the largest growths it has witnessed in the past decade. What happened?

- Rental prices were rising

- Demand was outweighing housing supply

- Property prices were soaring due to the stamp duty holiday

All three factors contributed to house prices increasing during pandemic.

New buyers’ priorities in the pandemic housing market

Our survey, The Homebuyer Wishlist 2021, reveals how the pandemic has changed the way UK homebuyers perceive property and the potential future trends we are likely to see over the remainder of 2021. The top 3 most important factors identified were:

- Garden and/or outdoor space – 92%

- Square footage of the property – 89%

- Broadband and mobile connectivity – 88%

Factors that have become far less important in the eyes of UK homebuyers over the past 24 months are:

- Transport links surrounding the property: Down 16%

- Distance to the nearest town or city: Down 13%

- Proximity to good schools: Down 12%

After several months stuck indoors due to regional lockdowns, it’s no surprise that the most important feature when buying a property has become the need for outdoor space – whether it be a garden or a communal area to sit or walk.

Seemingly, the effects of the pandemic have seen many employees now working from home on a semi-permanent basis. This has resulted in the importance of broadband and mobile connectivity moving from position 8 (of 15), to position 3. The rise in working from home is also the likely cause for the sudden dis-interest in transportation links, falling rank by 7 positions.

Post-pandemic housing market

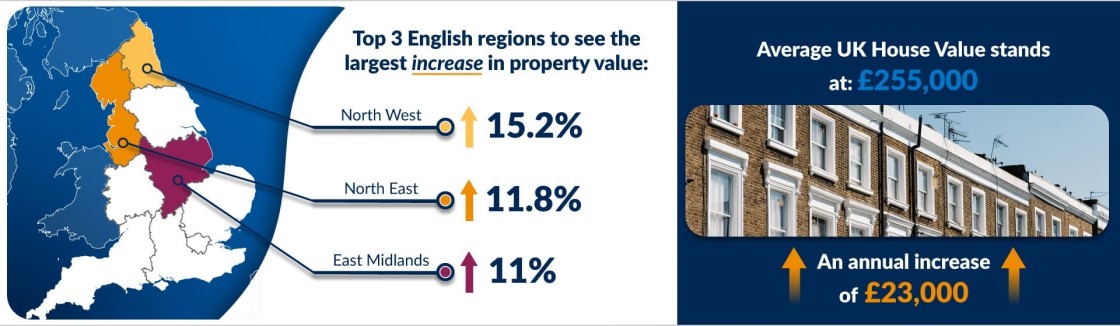

The increased interest in properties outside the big cities had an effect especially in North of England. The largest increase in property value in the post-Covid housing market were recorded in the North West with 12%, in Yorkshire & the Humber with 8.9% and the North East with 8.5%.

Source: Office of National Statistics UK House Price Index – January 2020 and January 2021

Moreover, the pandemic housing market reached a new peak in May 2021. House prices across UK recorded an 8.8% annual increase on average according to the Halifax’s latest house price index ( June 2021).

Although we saw a short halt of the property market during the first lockdown in April 2020, the pandemic housing market sped up again in the following months and led to new heights of property value across the country.

Disclaimer

MFS are a bridging loan and buy-to-let mortgage provider, not financial advisors. Therefore, Investors are encouraged to seek professional advice.