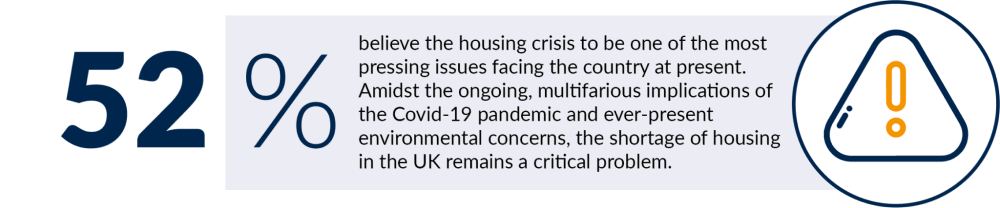

The UK housing crisis is one of the most significant societal issues affecting the country. A lack of available housing – particularly affordable housing – has resulted in rent and house prices rising sharply over many decades. In turn, millions of people across the UK are living in unsuitable accommodation, while many millions more are unable to purchase their own property.

The roots of the UK housing crisis

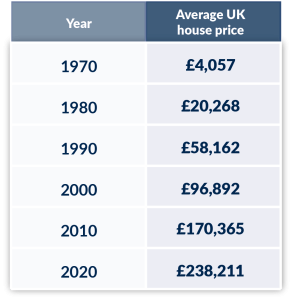

It is a complex, long-term problem that can be traced back more than half a century. Indeed, it has its roots in the decline of social housing and the sharp rise in property values, which became prevalent in the 1970s and 80s.

At the beginning of the 1970s, around one third of homes across Great Britain were affordable social housing provided by local authorities, according to government data. This ensured housing of a reasonable or affordable standard for those renting.

The Thatcher government then introduced further incentivises to the already-established Right to Buy scheme, which enabled council tenants to buy their homes for a reduced price. The Housing Act of 1980 ensured even greater discounts, resulting in more affordable and social housing moving into private ownership. This continued in the intervening decades.

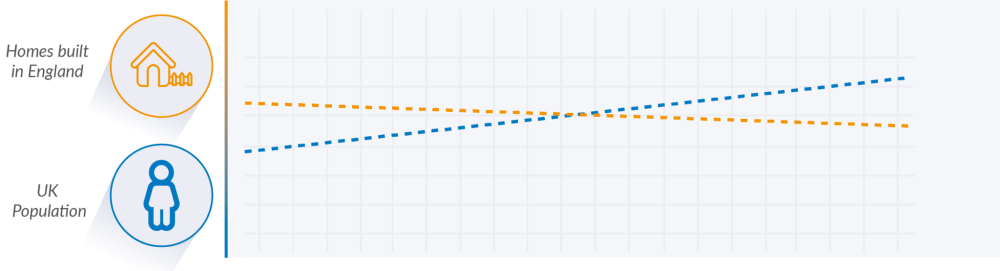

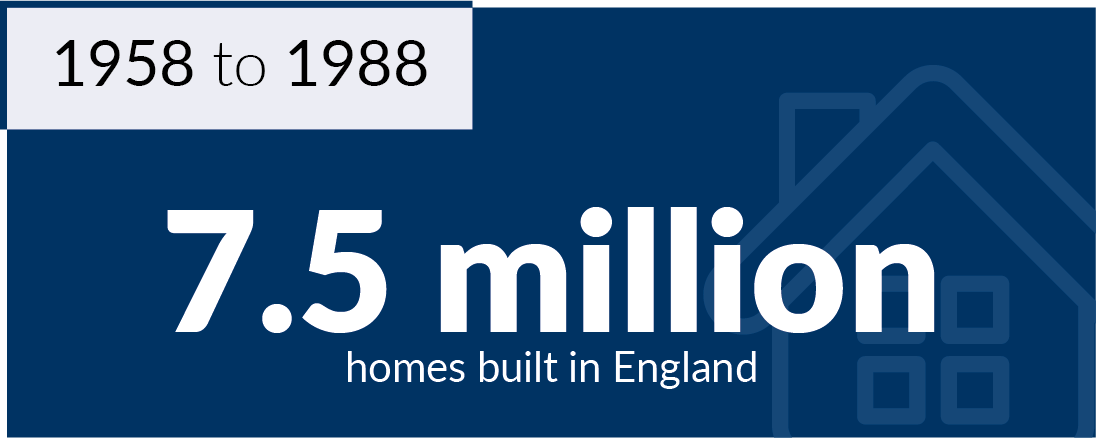

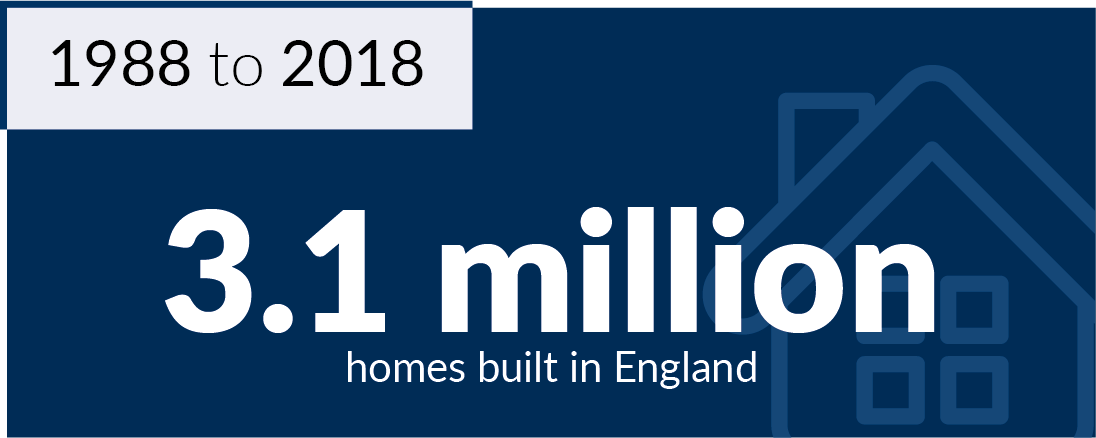

At the same time, homebuilding activity has dwindled while the population has grown at pace.

As noted, these converging trends have given birth to numerous issues.

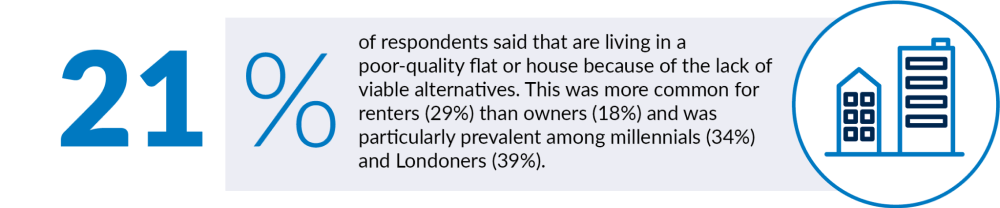

Firstly, there has been an increase in the number of people living in low-quality or unsuitable homes. It is calculated that, at present, more than 8 million people in England – around 1 in 7 – are living in an unaffordable, insecure or unsuitable home, according to the National Housing Federation.

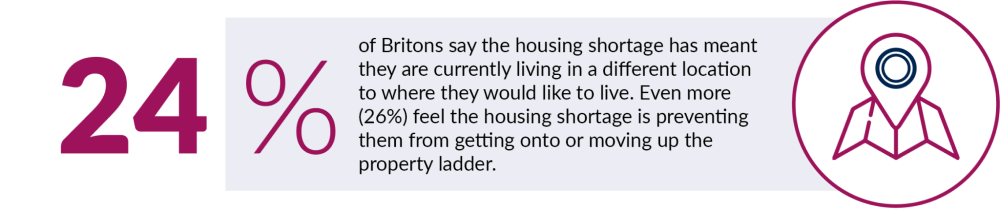

Secondly, the downtick in housebuilding and uptick in population numbers have converged to drive up house prices and rents. The result is that more people are stuck in rental accommodation, unable to save for and buy their own home.

A gleam of hope?

However, there were positive things to be taken from the number of homes delivered between 2019/20. It was the highest number of homes built in a single year since 1987, and it was also the seventh year in a row that the number of homes delivered has increased.

To delve further into this pertinent, emotive subject, Market Financial Solutions (MFS) commissioned an independent survey among a nationally representative sample of 2,000 UK adults. The survey respondents were asked about how the housing crisis has impacted their lives and the properties in which they live. Further, the research uncovers how much confidence the British public has in the Government’s ability – and desire – to address the housing crisis.

This report outlines the findings of the study.

Key findings of MFS’ housing crisis survey

The independent survey commissioned by MFS was carried out between the 22nd and 27th October 2021, by market research agency Opinium.

Navigating the housing shortage

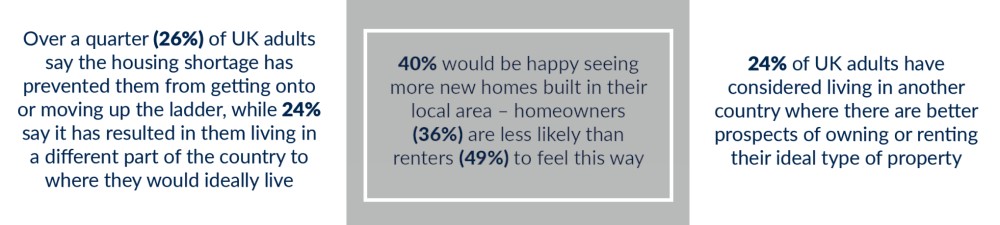

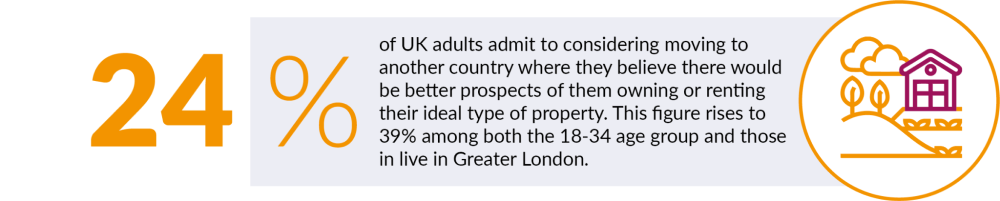

These statistics underline how restrictive the lack of available housing options is for people across the UK. With rents or house prices prohibitively high for some, they are left with little choice but to live in poor-quality homes, or in different parts of the country to where they wish to live.

What can be done to solve the UK housing crisis?

Confidence in the UK Government and a resolution

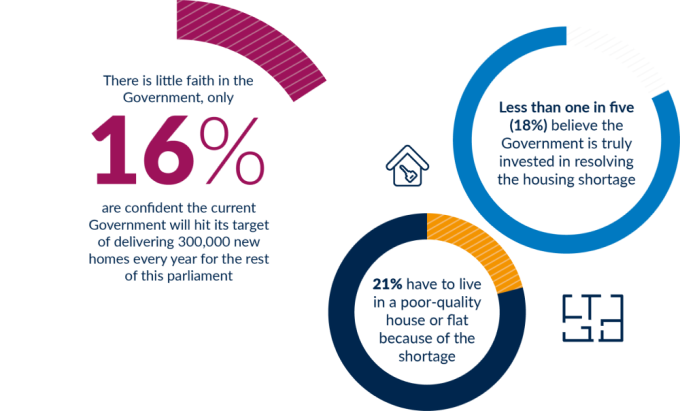

Focus, then, turns to the Government and how much confidence the British public has in it to find a resolution to the UK housing crisis.

MFS’ independent study reveals that just 16% of UK adults are confident the Government can meet its target of delivering 300,000 new homes every year over the next five years.

Moreover, less than a fifth (18%) believe Boris Johnson and his party are truly invested in resolving the housing shortage.

Perhaps unsurprisingly, therefore, a mere 14% of respondents are confident the housing crisis in the UK will be resolved by 2030, with women (10%) less

confident than men (17%) in this outcome.

Only fractionally more people (15%) believe they will see the problem eradicated in their lifetime.

More broadly, just 14% of people – falling to 12% among renters – feel the gap between salaries and house prices will narrow in the coming decade.

Moreover, the survey found that less than one in three (30%) people are confident they will one day live in their dream home.

Focus on sustainability

Elsewhere, MFS’ study delved into sustainability, which has become an increasingly prevalent subject in recent months, particularly with COP26 taking place in early November 2021.

The way that homes are built and run has a critical role to play in tackling climate change.

Thoughts of MFS

The complexity of the UK housing crisis and its ramifications on different pockets of society cannot be underestimated. But MFS’ research certainly unearths many prevalent issues, all of which warrant urgent attention.

First and foremost, the fundamental truth is that the lack of available housing – and the way in which this pushes up property prices and rents – is leading to large portions of the UK public having to live in low-quality homes, or in places they do not actually want to be. Clearly, the country’s

housing stock must be ramped up, and fast.

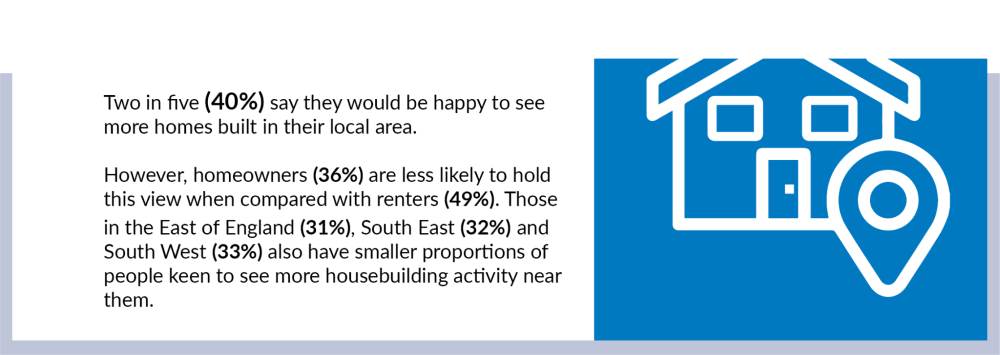

Creative efforts will no doubt be needed to achieve this, with the public and private sectors having to collaborate closely. Planning reforms will be important; this will reduce red tape and ensure more property developers get the green light to build homes. In line with this, the Government must

assess how available land across the country can be best used for new-builds – brownfield land is under the microscope, and changes will likely be introduced to free up such areas for residential construction projects.

Interestingly, MFS’ research highlights that more people want to see commercial properties converted into residential dwellings. This is a pertinent topic, given the pandemic has resulted in many commercial premises being vacated – could these buildings be repurposed to turn them into potential homes? Expect this to be a heated debate in the coming months.

One of the biggest takeaways, however, is the lack of confidence that the UK public ultimately has in the Government. The vast majority do not feel Boris Johnson will meet their new-build targets, or indeed that the current Government has fully invested in tackling the crisis.

This is understandable. For decades, Britons have heard politicians set bold targets for how many new homes will be built in a certain year or parliament – these targets have been missed time and time again. This has eroded trust, to the point at which people clearly do not believe that MPs are capable or interested in resolving the UK housing crisis.

As the UK emerges from the pandemic, more must be done by stakeholders across the property sector. Most notably, the Government must combine policy reform with public investment to ensure housebuilding activity accelerates. But the property finance sector has a role to play.

At MFS, we are calling on lenders to support where possible. For instance, we supply bridging loans to allow investors to convert commercial properties into residential dwellings; extend existing homes; and renovate derelict buildings. This, and much more besides, has to remain a focus for lenders.

If financial resources can be put behind those that are able to deliver the physical housing infrastructure required, then there is a far better chance that the housing crisis can be addressed in the years to come. As our research shows – there is not a moment to be wasted.

Disclaimer

MFS are a bridging loan and buy-to-let mortgage provider, not financial advisors. Therefore, Investors are encouraged to seek professional advice.