It’s been over 2.5 years since the UK officially left the European Union. It’s been 6 years since the original Brexit referendum. And in that time, alongside the political and economic uncertainty the referendum initially caused, the UK’s housing market has also had to contend with a pandemic. However, Brexit hasn’t had the impact many experts expected. This blog will outline how Brexit has affected UK property investments and consider multiple aspects of the market. Additionally, we will assess what qualities investors and landlords should look for in a lender to help navigate the post-Brexit investment landscape.

1. House Prices

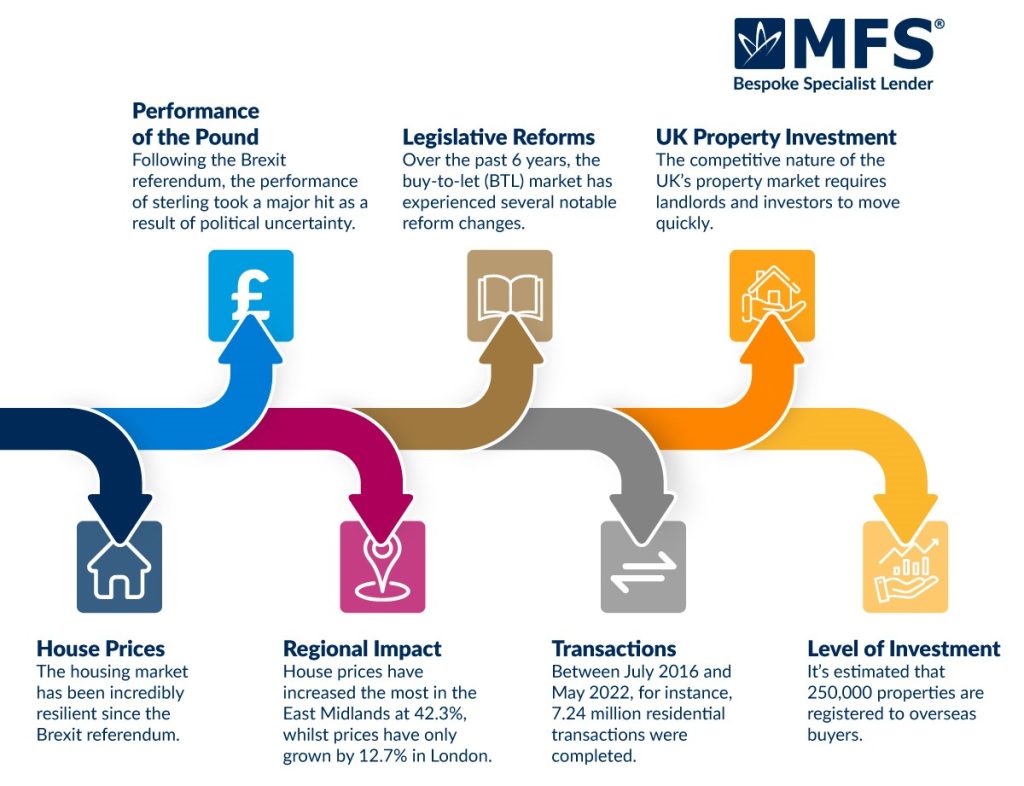

The housing market has been incredibly resilient since the Brexit referendum. Certainly, the performance of UK house prices is a good barometer for this. Initially, it was thought the decision could spark an 18% decline in the sector, on top of the forecasted 20% fall because of Covid. In reality, house prices grew by 32% between July 2016 and May 2022. In the six years leading up to the referendum, the market only grew by 22.5%.

Source: Knight Frank

It’s worth noting that between 2017 and 2019 – when political uncertainty was perhaps at its highest – the market did begin to level off.

However, growth recovered once again post-Theresa May’s departure and throughout the pandemic. Perhaps political turmoil in Westminster had a greater bearing on the market than the choice to leave the EU. Indeed, the fact remains that demand continues to outstrip supply, which is perhaps why prices continue to rise despite the political and economic factors at play. For example, in May 2022, the average price of a house reached £283,000, according to the Office for National Statistics (ONS). In May 2021, this figure was £32,000 lower. Whilst prices increased by 1.2% between April and May 2022, the same period only saw 0.4% growth in 2021.

Source: Office for National Statistics

What’s clear is that because demand is so high, Brexit has not had the impact on prices many experts initially predicted. In fact, the success of the market looks set to continue, with some experts suggesting that prices are going to increase by nearly 19% across the UK by 2026.

Source: RW Invest

2. The regional impact

That said, prices do vary around the country. So it’s important to recognise the regional differences at play in the market.

Historically, London has outperformed the UK’s regions. However, London is now lagging behind. For instance, house prices have increased the most in the East Midlands at 42.3%, whilst prices have only grown by 12.7% in London. In truth, affordability pressures and an adverse tax landscape have pressured London’s prices lower, but political volatility has certainly compounded these issues. In other words, Brexit is not the key driver for this levelling up of the UK’s regions, but it has played a role in London’s dip in growth.

Source: Buy Association

3. Transactions in the market

A similarly useful metric for tracking, how Brexit affected UK’s property investments, is the number of transactions. Whilst transactions did suffer following the 2017 general election that left Theresa May’s government without a working majority, the impact was less than initially forecast. Between July 2016 and May 2022, for instance, 7.24 million residential transactions were completed. That was a 14.4% increase (from 6.32 million) on the six years leading up to the referendum.

Source: Knight Frank

Of course, the pandemic had an initial impact on transactions. But the market soon recovered following the announcement of a stamp duty holiday which generated a reported 140,000 ‘extra’ transactions.

Source: FT Adviser

4. Levels of investment

The level of investment into the UK’s property market can also demonstrate the affect of Brexit. For some time, overseas investors contributed a significant amount to the real estate sector. In fact, it’s estimated that 250,000 properties are registered to overseas buyers. This equates to around 1% of all residential titles. In 2010, however, this figure stood at 0.4%. As such, it’s clear investment from overseas grew during the Brexit period.

Source: Chestertons First

5. Performance of the pound

Related to overseas investements is the performance of the pound. Following the Brexit referendum, the performance of sterling took a major hit as a result of political uncertainty. Consequently, a forex window appeared that made UK property a significantly cheaper option to overseas purchases.

In particular, USD investors benefitted from the collapse of the pound. This meant prime UK property was effectively being sold at a discount of around 30%.

Whilst the gap between USD and GBP has shrunk slightly, the UK’s economy looks less robust than the US. Therefore, USD is quietly gaining on the pound and significant savings could be on offer that might attract a fresh wave of overseas investors.

Source: Chestertons First

6. Legislative reform as a result of Brexit

Over the past 6 years, the buy-to-let (BTL) market has experienced several notable reform changes. Those which will have impacted property investors and landlords.

- April 2016: an additional 3% stamp duty surcharge is introduced for second homes.

- April 2017: a tapered reduction in mortgage interest tax relief is introduced, leading to its removal in 2021. Landlords now receive a 20% tax credit. This means that those paying basic rates will be unaffected. However, landlords who pay higher and additional rates will pay more.

- October 2018: new regulations are brought in for houses in multiple occupation (HMOs). The changes included prohibiting landlords from renting rooms with less than 6.51m² to single adults. For two adults, the figure increased to 10.22m².

- April 2019: the Government tables a motion to abolish section 21 of the Housing Act 1988. It announces that “private landlords will no longer be able to evict tenants from their homes at short notice and without good reason”. In May 2021 it was confirmed that the Bill was to be brought forward to establish this reform.

- March 2020: in response to the Covid-19 pandemic, with many tenants placed on the Furlough scheme, the Government introduced The Coronavirus Act 2020. It protected tenants by delaying landlords’ ability to evict. Landlords had to provide six months’ notice before starting the process. (This was in place from August 2020 to June 2021.)

This series of reforms has caused landlords to reassess how they invest and manage their portfolios. For instance, the new HMO regulations have resulted in significant refurbishment and renovation activity, as landlords sought to bring their properties in line with the new regulations.

One could argue that instead of Brexit affecting UK property investments, Britain’s own legislative choices and reforms impacted the market.

7. UK property investment post-Brexit

Whether buying a property or renovating one, it is vital that brokers and investors find the right financial products to finance their investments post-Brexit. So, what qualities should their loan provider possess?

Firstly, Brexit and legislative reforms have increased the complexity of the UK property market, so lender flexibility is key. Here at MFS, our financial products offer investors and landlords a wide range of financial options to cater for any investment. Whether it’s to complete a property sale or free up funds for another investment opportunity, our underwriters treat each loan application on a case-by-case basis and underwrite from day one. In doing so, we take all aspects of an application and investment opportunity into consideration. As such, we can take on cases other lenders might shy away from.

Secondly, the competitive nature of the UK’s property market requires landlords and investors to move quickly, so lender speed is vital. At MFS, we can complete deals in as little as three days, alleviating the stress of a quick turnaround. With our Auction Bridging Loans, we can help auction-winning landlords complete a purchase within the 28-day deadline. Alternatively, if a developer needs to repay a development finance loan, our Development Exit loans can give them breathing space to find buyers or complete the renovation of a property.

Finally, investors – overseas or otherwise – must feel secure when taking out a loan to complete an investment opportunity. As such, lender transparency is key. At MFS, client trust is very important to us, which is why we provide indicative loan terms upfront so our clients can invest with confidence. Once we agree to these terms – we never adjust the rates or go back on a deal.

Disclaimer

MFS are a bridging loan and buy-to-let mortgage provider, not financial advisors. Therefore, Investors are encouraged to seek professional advice.