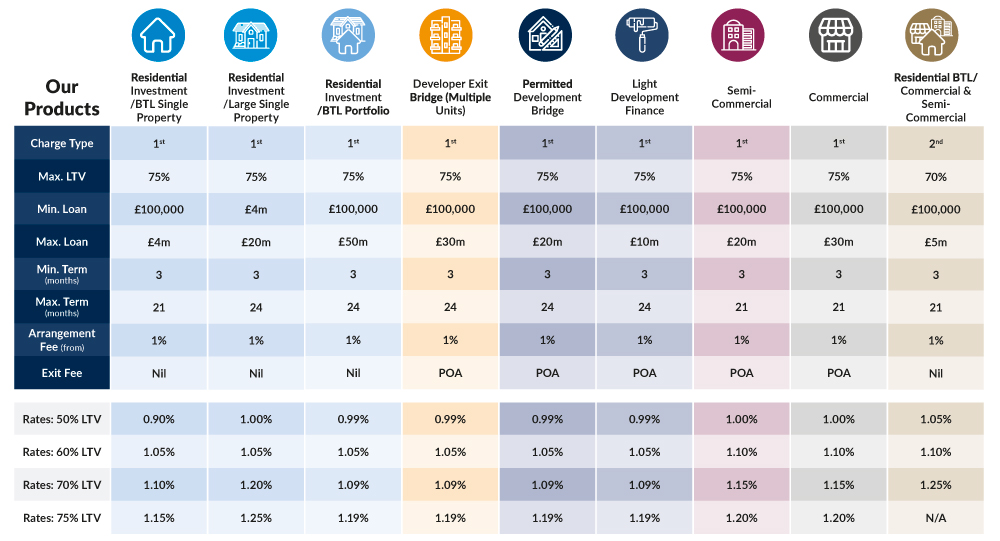

Our bridging rates table is reflective of our Q4 2022 bridging loan rates.

Bridging Loan Rates

Instant quote at your finger tips

From property renovation to development exit, you can use our calculator to receive a detailed quote regarding a potential bridge loan with MFS – so you know what to expect from the get-go.

Working in the same dynamic as our bridging calculator, our buy-to-let calculator will help you find out how much you can borrow for the product that you need.

MFS Bridging Loan Rates

We update our bridging loan rates on an ongoing, live basis. This means what you see on this page is the absolute latest information available. As is the case across all of our business, clarity remains paramount – for both us and our underlying clients.

The bridge loan rates we have on offer will be varied by a range of factors. A borrower’s specific circumstances will be amongst the most important elements in determining what bridging finance rates are issued. This can include a borrower’s financial background, whether they’re based overseas, and if there are any CCJs against them.

The type of property being invested into will also have an impact on rates. We offer loans for a broad range of property types, but each will be assessed on a case-by-case basis. A loan for a residential, one-bedroom apartment will likely have a much different rate to a large commercial logistics hub. How the property investment will be utilised down the line will also affect the bridging loan rate. Before the issuing of any loan, MFS thoroughly ensures there is a solid exit strategy in place.

As is the case with any lender, our bridge loan rates are also subject to the wider economic climate. Chiefly, this concerns decisions made by the Bank of the England on the base rate. Where we are forced to raise our rates, we go out of our way to let our brokers know asap. Additionally, all of our marketing materials will be updated to reflect the changes.

To ensure our brokers and underlying clients receive the fairest bridging finance rates, along with unparalleled service, all of our deals are assigned to a designated underwriter. Our underwriters go out of their way to provide the best possible deal. This includes doing all the heavy lifting. They’ll chase paperwork; liaise with lawyers and valuers; and analyse the wider market. This is all done to make sure we understand the full picture and limit your costs wherever possible.

With this dedication in place, we can fix our bridging loan rates securely so you can invest with confidence. Once the terms are agreed, we’ll never go back on a deal. When we say yes, we mean it. To see what rates we can offer you, give us a call and we’ll be happy to help you.

There is a human behind the chat

Prefer to chat to someone? The Underwriter that you speak to over the phone or in person, is the same one on our Chatbot. Get answers immediately without needing to wait!